Perfect Timing

How playing the game of 'timing the market' can lead to sub-optimal long-term returns

One of the most frequent questions I get asked is…

“Is now a good time to invest?”

My answer…

“Probably.”

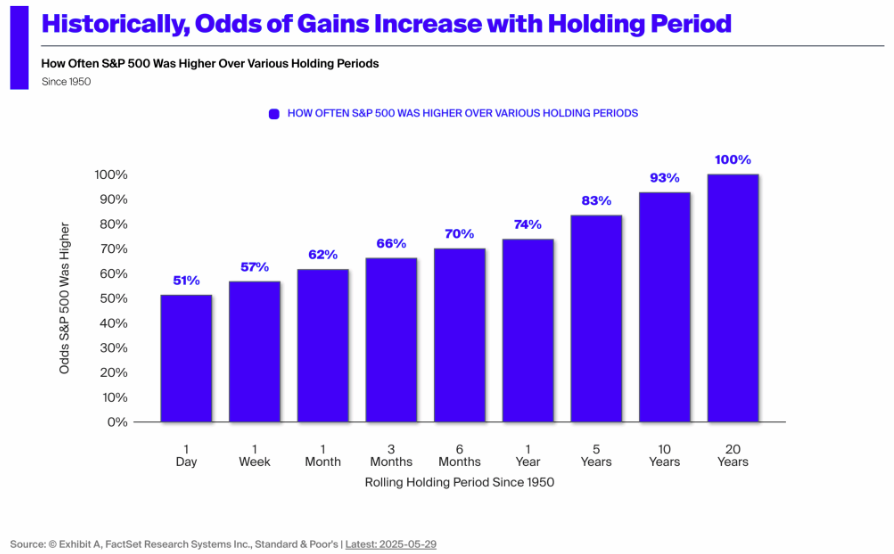

I say probably, because when looking back at historical data to 1950, the US market is higher on average 83% of the time 5 years later, 93% of the time 10 years later, and 100% of the time 20 years later.

So is now a good time to invest? Statistically speaking, it probably is.

Why do so many people ask this question, and how does human psychology play such a critical role in people’s investing journeys?

Why do people care so much about trying to achieve the perfect timing to invest?

Perfect Timing

If there’s one thing that’s certain when investing, it’s that you’ll always find a reason to not invest. Whether it’s because of new tariffs, geopolitical uncertainty, or because the market has already gone up +20% and you feel that you’ve missed your opportunity to enter at a “good price”, you will always find a reason to wait a little longer.

Unfortunately, it’s this game of waiting that erodes potential growth in your portfolio, and will more often than not lead to lower long-term investment returns. There is no such thing as perfect timing.

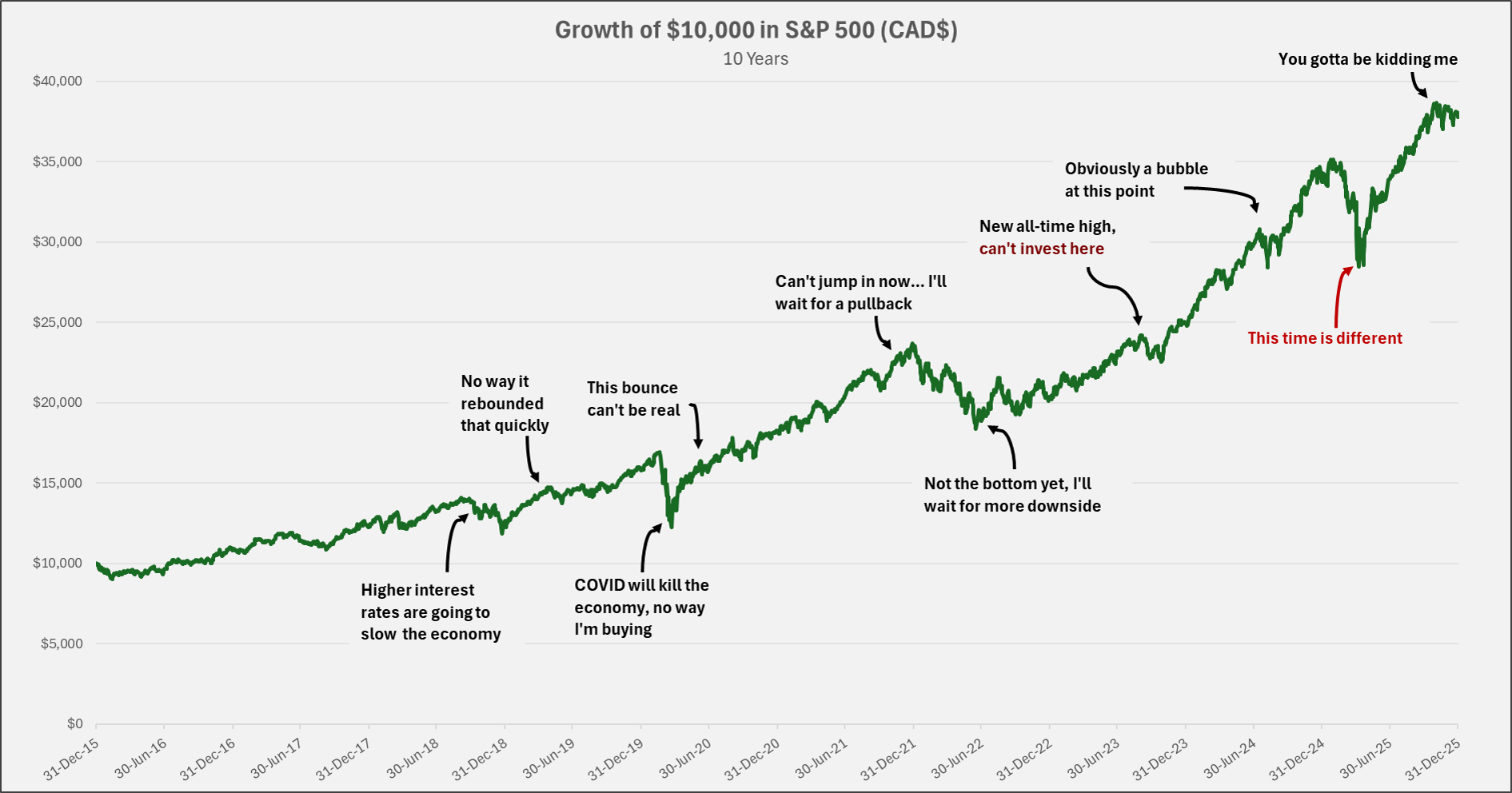

The past 10 years in the US stock market have been great for steady long-term investors, but it’s come with many bumps in the road (investing is never a “smooth ride”). There’s always going to be times of panic and fear, but also times of exuberance and greed.

The best way to invest is to ignore both.

Source: Yahoo Finance (HXS.TO Historical Prices) December 31, 2015 - December 31, 2025

The US stock market has returned over 250% in the past ten years. This appreciation has not come without several ups and downs:

- Fall 2018, increasing interest rates spooked investors and the market dropped 20%, only to fully recover within 3 months

- March 2020, COVID-19 sent the market plunging 27%, only to fully recover 4.5 months later

- Fall 2022, aka “The Tech Wreck”, sent the market down 23%, but again, fully recovered in 13 months

- Spring 2025, after a stellar growth year in 2024 for stocks, the threat of new global tariffs sent the market down 19%, but fully recovered in 6 months

What’s the lesson? The market will always go up and down, and it’s impossible to know exactly when the tops and bottoms will be.

The best way to ensure strong long-term returns is to stay invested when the market is up, and to add when the market is down.

Investing at All-Time Highs

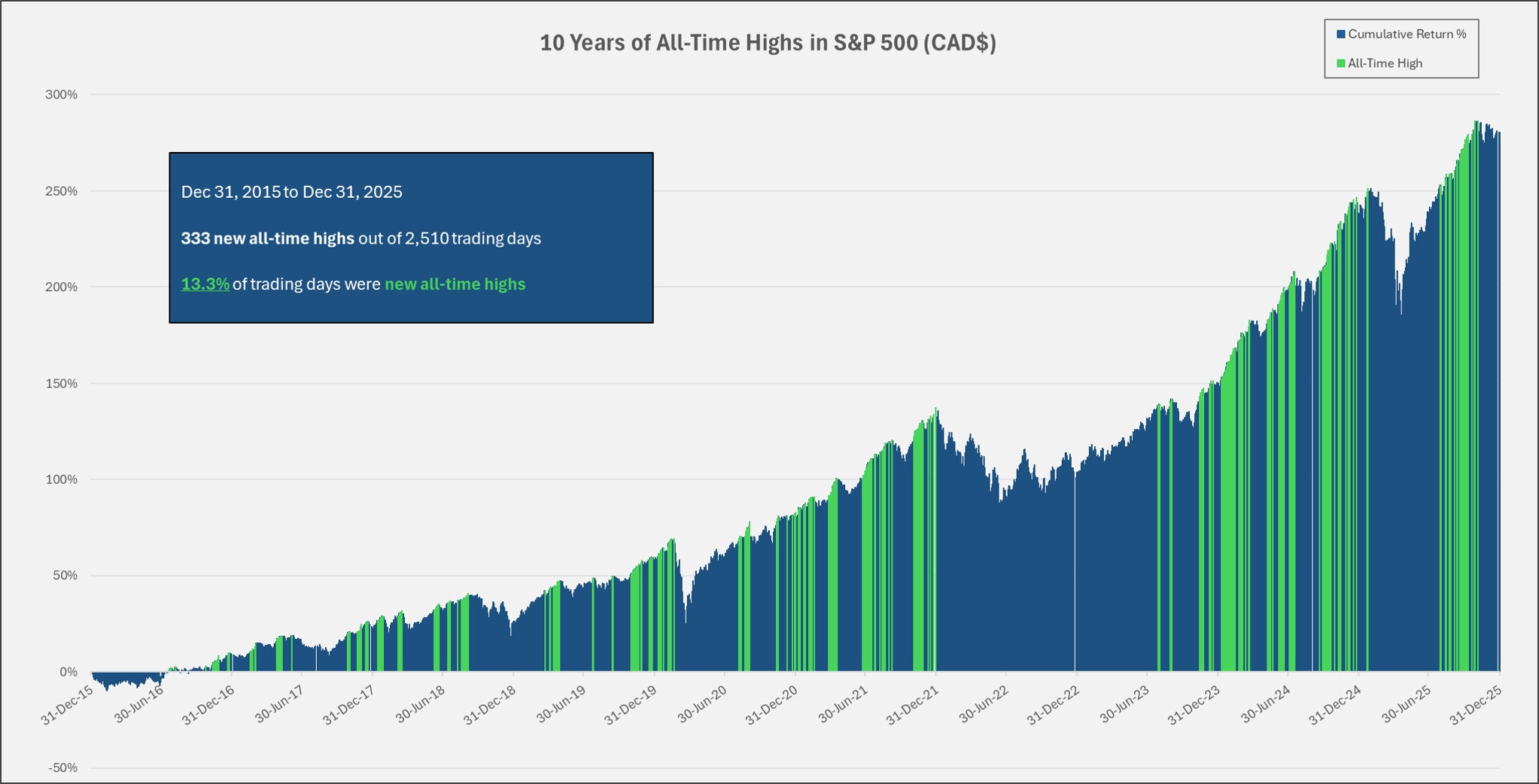

I tend to get the question, “Should I wait to invest?” particularly when markets are at or near all-time highs.

When markets are high, people often perceive that to mean that they have greater probability to fall.

Let’s see if this is true, by looking at the returns of the S&P 500 Index over the past 10 years:

Source: Yahoo Finance (HXS.TO Historical Prices) December 31, 2015 - December 31, 2025

Would you believe me if I told you that…

Over the past 10 years, the S&P 500 hit a new all-time high on 13.3% of trading days (333 out of 2,510 possible days)

Of these 333 new all-time highs, fast forward one year and the market was higher 84.5% of the time

Not only was it higher, but the average 1-year return after hitting an all-time high was 11.9%

High points in the stock market do not automatically mean it’s time to sell. If you had followed this rule over the past 10 years, you would’ve been wrong 85% of the time.

Intuitively, it feels wrong (and for some reason more risky) to invest money when the market has never been higher. This is normal human behaviour, and that’s why investing is so difficult.

The most successful investors are the ones that don’t let “normal” human behaviour get in the way of making smart long-term choices.

This is also how having a good financial advisor can help.

Timing the Market: Why It’s So Hard

In a perfect world, you’d be able to sell at highs and buy at lows, achieving perfect upside capture while avoiding all downside.

Unfortunately, this is not possible.

Trying to accomplish this will most likely lead to worse returns and disappointing results.

Ben Carlson, writer for A Wealth of Common Sense, said it best:

“Timing the market successfully means being right twice”

One must make a decision to buy then sell, or sell then buy back again.

History has proven that it’s extremely difficult to time the market correctly once, let alone twice. Very few people who correctly sold before the Great Financial Crisis of 2008 also managed to buy back in at the right time at the bottom.

Many stayed overly defensive and missed the recovery, showing that all-in or all-out strategies require two perfect decisions, which is incredibly difficult to accomplish.

Psychology also plays a huge role in timing the market, especially when a decision has been made to sell, and the next decision is to get back in.

In a falling market, it’s incredibly difficult to choose a point to get back in and stick with it. There’s a certain comfort that comes with not participating in the freefall, and the hurdle level the market must cross to re-enter always tends to be pushed a little lower each day the market decreases.

When the inevitable bounce back occurs (think back to April 2025 when the market was +8% in a single day after a series of negative days), it’s even harder to pull the trigger. You feel like you’ve missed your chance, so you wait for the next drop to re-enter — but it most likely won’t come.

This is the game, and it’s impossible to win.

Being a successful investor isn’t about getting into the market on a low — it’s about staying invested when it feels uncomfortable.

It’s about “being greedy when others are fearful” (-Warren Buffet).

Make a plan, stick to the plan, keep adding when you can, and the long-term effect of compounding will do the heavy lifting for you.

~~~

-

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This commentary was written by Jackson Gustafson-Fish, Financial Advisor with Stratton Wealth, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this commentary comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds are offered through Investia Financial Services Inc. Please read the Fund Facts sheet or prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.