Start Early, Invest Less

Why Investing Early is the Key to Building Wealth

Back Story

I remember as a kid in high school, the thought of investing for my eventual retirement felt ridiculous. Why at the age of 16 am I saving for when I’m 65 years old? My stepdad, Ed, who’s now also my business partner, convinced me that it was necessary and that I’d be thanking him in the future for convincing me to start investing at such a young age. I was unfamiliar with the concept of investing at the time—it seemed a little scary and was rather confusing—but I was eager to learn so I trusted him and began my investing journey.

I was able to scrape up a small sum to invest through various summer jobs. I’d often find myself asking questions such as, “What’s the point of investing so little? It’s not going to make any difference in the long run,” or, “Is this even worth it?” Looking back now, I know exactly why Ed convinced me to start so early—it wasn’t about building a massive portfolio by the time I graduated high school (or even university), because we both knew that wasn’t going to happen—rather, it was about building the habit and the routine of investing on a set schedule and becoming comfortable with this pattern. It was about building familiarity and trust in the process so that I could better understand how a simple, diligent strategy works to build substantial wealth over the long-term.

The process is deceptively simple. Invest monthly (even if it’s not a large amount), stick to your plan, and have patience. If you can follow these rules, you will continually be building towards an investment portfolio that grows and continues to grow rapidly on the back of compounded growth.

The Snowball Effect

What is compounding? Compounding growth is like rolling a snowball. It starts off really tiny and must be rolled many (many) times before it becomes a decent size. However, once it becomes a decent size, one full roll will add significant snow to the ball and increase its size more substantially than the first rolls. Then the next one will get even bigger, and it will become larger much more quickly. This is the snowball effect, otherwise known as compounding. In terms of investing, let’s assume you’ve invested $1,000. A 10% return on that $1,000 investment is $100, resulting in a total value of $1,100. Next year you achieve another 10% return, but this time it’s on the new total value of $1,100, meaning your gain is $110 instead of $100—now you have $1,210. This is compounding. Pair this concept with a ritual of investing periodically, and the growth over decades becomes sizeable.

Start Early, Invest Less

The math of compounding is truly incredible. Starting early does more than just build good habits—it also drastically lowers the amount of money that needs to be invested to reach your retirement goals. The chart below shows the various monthly contributions required at various ages to reach $1,000,000. The model assumes a 9% rate of return, 2% of inflation, and retirement at 65 years of age. The gold bars represent growth in the portfolio, while the blue represents what’s been contributed.

As you can see, the earlier you start investing, the less you’re required to contribute over your lifetime to hit your retirement goal. For example, if you start investing at the age of 20, it takes $243.73 per month invested to reach $1 million by age 65. You will have contributed $134,537 and the growth of your portfolio will account for the other 86.5% of its value. By waiting 10 years and starting at the age of 30 instead, it would take more than double the monthly payment to reach the exact same retirement goal ($511.51 per month), and you would have to contribute $220,974 over 35 years.

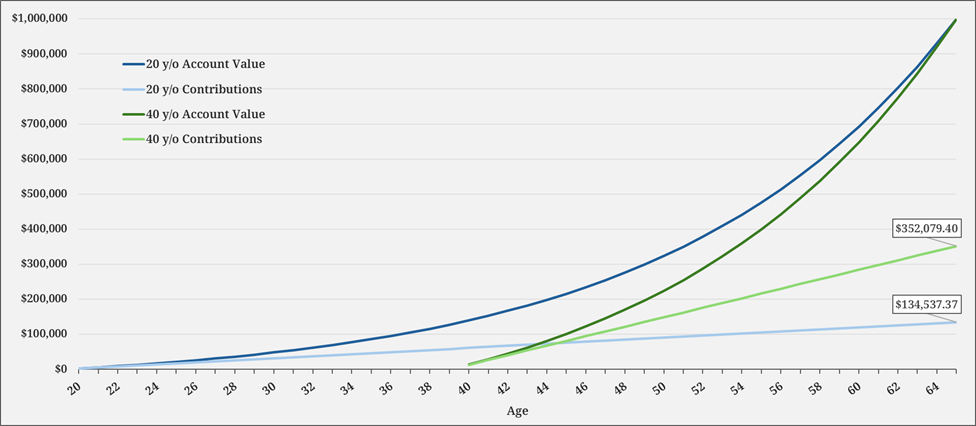

Let’s look at another illustration that demonstrates the concept of smaller contributions over a longer period, versus larger contributions over a shorter period. The line chart below shows the trajectory of monthly investment contributions starting at 20 years old (blue lines) and compares it to the trajectory of someone who waits until they’re 40 years old (green lines), where the lighter lines illustrate your contributions, and the darker lines illustrate your investment value including growth. To reach $1 million by the age of 65, you would need to invest 2.6x more than someone who started at the age of 20—that’s significant.

“Your first $100,000 will be the hardest and will take the longest”, a phrase that legendary investor, Charlie Munger of Berkshire Hathaway, once said at a shareholder meeting in the late 1990s. This could not be truer, as a good portion of that $100,000 will need to come from saved income, rather than earned through compounded growth of your investments. As shown in the line chart above, it takes almost 17 years to get to $100,000. If you start at the age of 20, you wouldn’t get to this milestone until your 37… patience is a virtue, right? Well, here’s the good news—once you hit the $100,000 mark, it gets easier. Due to the magic of compounding, the next $100,000 comes in only 8 years. Then the next $100,000 comes in 5 years, then 3 years, and so on. This apparent “shrinking of time” that is required to build wealth as your portfolio grows, is the power of compounding working for you and is why time is so important.

Now let’s compare that to if you wait until you’re 40 years old to start investing. You can see that when looking at the straight light green line in the chart above, in just the first 4 years of investing, you’ve already contributed the same amount as if you had started at 20 years old. At 44 years old, the amount invested is the same, but the total account value is 2.4x larger for the investor who started at age 20. The longer you wait to begin investing, the more you need to play ‘catch-up’ with larger investment contributions. Larger contributions means less money for you to spend on your typical day-to-day. Start early, invest less.

Another Perspective

If I haven’t yet been able to convince you that time is your best friend and that’s it’s critical to start investing as early as possible, below is another perspective to help illustrate this concept. Let’s visualize the power of time by using the same monthly investment amount of $350, but starting at different ages to see the impact it would have on your investment portfolio by the age of 65. We’ll use all of the same rate of return assumptions as before in the previous illustrations.

The blue line is starting at 25 years old, green line is waiting until 30 years old, and the gold line is waiting until 35 years old.

By starting at 25 years old (blue line), you nearly achieve your $1 million target, with the vast majority of growth occurring in the final 10 years (almost 50%). When starting at 30 years old (green line), you end up with a portfolio that’s smaller by $315,000, or about 31%. The gold line represents waiting until you are 35 years old, and this portfolio is $530,000 smaller, or 53%. As seen in the blue line, most of the growth occurs in the final years once the portfolio is of substantial size. This is because a 10% return on $800,000 is much larger than a 10% return on $100,000. A patient investor will reap the rewards of large gains in 30+ years, by being content with small monetary gains at the start. It’s all part of the process, and it’s exactly what we’re here to help you achieve at Stratton Wealth.

If there could be one take away from this chart, it’s that the majority of growth occurs in the final years of investment. The growth will be minimal in the first 10, even 15 years, and that’s okay! Look at the blue line above. The investor who started at the age of 25 will only have $125,000 after 15 years of investing. After 20 years they will have just crossed $200,000, but that’s okay, because it’s part of the plan and the majority of growth happens at the end once the portfolio is sizeable. As I mentioned before, patience is the key to success with investing for the long-term.

Let’s Simplify

I’ve thrown a lot of math and numbers at you in the paragraphs above, so let’s simplify:

By investing early, you build strong habits for saving and learn how to adhere to a pattern of putting money away for your retirement years.

By investing early, you’re able to become comfortable with the idea of investing and how it works slowly over time, without needing to invest large sums of money.

By investing early, you’re able to take full advantage of compounding growth over as many years as possible.

By investing early, you’re able to invest less to achieve your retirement goal.

Let the power of compounding work for you, and roll your snowball for as long as you can. Building wealth does not happen overnight—it takes patience, consistency, and trust. Stick to your plan, continue to embrace market volatility rather than fear it, and allow for compounding to work to its full extent.

Are you investing? Is your money working for you? Do you have a financial plan in place that will get you to the point you desire to retire comfortably? The time to think about this is now.